We are pleased to announce that our efforts have paid off in containing the GST slab for budget hotels. The Finance Ministry has decided that hotels and lodges with tariffs below Rs 1000 per day will be exempted from GST, while rooms priced between Rs 1000-Rs 2,500 will be taxed at 12 percent. The decision not only recognizes the critical role played by the Indian Hospitality Industry in its contribution to the GDP along with employment generation but also serves the needs of the common man.

What happened behind the scenes:

As the nation awaited the new tax regime of GST, there was concern over how this would impact small and budget hotels and if they would be taxed at a higher slab than before. As a hospitality company, it was extremely important for us to protect the interests of our hotel partners and find solutions that work in favour of growth of the tourism and hospitality industry in the country. In the run-up to the GST Council meeting, we wanted to create visibility for the concerns of our hotel partners and advocate a 5% GST for small hotels.

The tax slab for hotels was expected to increase to 18%-28% under Goods & Services Tax (GST). We launched an intensive campaign on a war-footing across 20 Indian states. Our representatives travelled across the country with our hotel partners to meet Ministry representatives of different states and inform them about the implications of such a move on the budget hotel industry. FICCI provided representation to small hotel owners and helped them table their request of a lower tax slab to Chief Ministers and Finance Ministers of 10 states. Our intense and wide-spread advocacy efforts in the last five months also included conducting meetings with senior officials of the GST Council Secretariat, NITI Aayog and the Prime Minister’s Office in New Delhi. While meeting the ministers, FICCI and OYO Partners emphasized on the fact that the budget category comprises 80% of the market. A substantial increase in taxes would have resulted in higher tariffs for end-customers completely changing the structure of the industry.

A low tax rate on budget hotels is important in the GST regime, to ensure that the cost burden is not passed on to the lower and middle strata of the society who are the biggest customers for budget hotels. Tariff with low tax rates will also significantly increase foreign and domestic travel in India leading to a positive impact on tourism-induced employment and revenue collections.

This development would not have been possible without the support of our hotel partners, FICCI, the media and most importantly government stakeholders who were sensitive to the demands of the common people. Thank you all for making this a success.

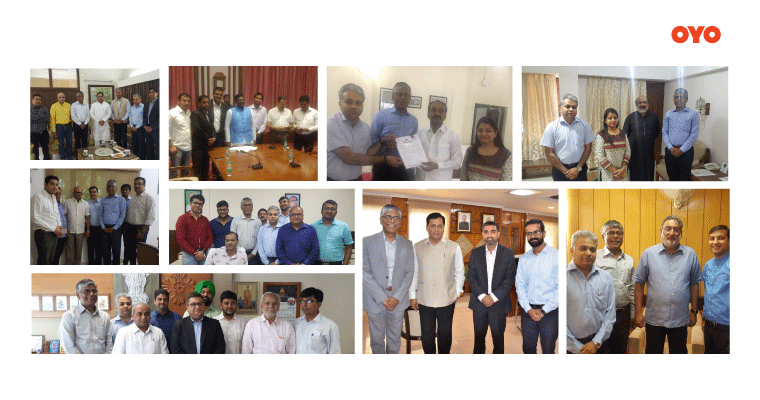

Below are a few pictures of OYO hotel partners and the OYO team meeting Finance Ministers of different states and resultant coverage in the press.